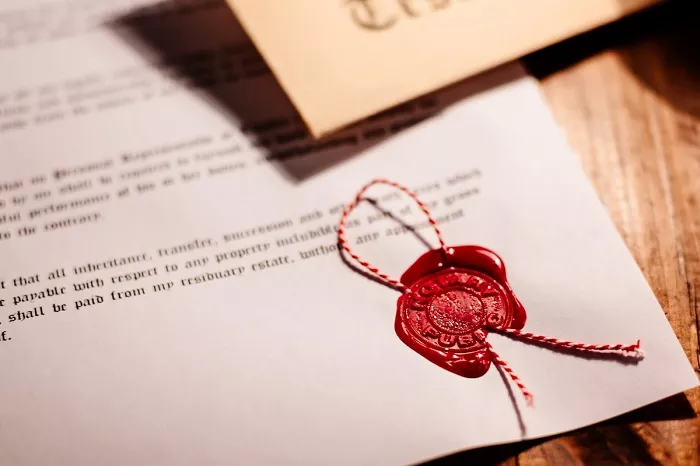

Receiving an inheritance can be a life-changing event, presenting both opportunities and challenges. It’s crucial to approach the investment of this newfound wealth with careful consideration and a well-thought-out plan. The decisions you make can have a significant impact on your financial future, whether it’s achieving long-term financial security, funding your dreams, or leaving a legacy for future generations. In this comprehensive guide, we will explore various aspects and strategies to help you make informed decisions on how to invest your inheritance.

Assess Your Current Financial Situation

Debt Management

Before considering any investment options, it’s essential to take stock of your existing debts. High-interest debts, such as credit card balances, personal loans, or payday loans, can be a significant drain on your finances. Paying off these debts should be a top priority as it provides an immediate return in the form of saved interest payments. For example, if you have a credit card balance with an annual interest rate of 20%, paying it off is equivalent to earning a 20% return on your money, which is much higher than most traditional investment returns.

Emergency Fund

Establishing or bolstering an emergency fund is another critical step. An emergency fund acts as a financial safety net, providing you with the means to cover unexpected expenses such as medical bills, car repairs, or job loss. Aim to save three to six months’ worth of living expenses in a liquid and easily accessible account, such as a high-yield savings account. This ensures that you won’t have to dip into your investments prematurely in case of an emergency, which could disrupt your long-term investment plan.

Define Your Financial Goals

Short-Term Goals (1-3 Years)

Short-term goals could include saving for a down payment on a house, taking a dream vacation, or purchasing a new car. These goals are typically more immediate and require relatively liquid funds. For example, if you plan to buy a house within the next two years, you might consider investing a portion of your inheritance in a short-term certificate of deposit (CD) or a money market account. These investments offer a relatively stable return and ensure that the funds will be available when you need them.

Medium-Term Goals (3-10 Years)

Medium-term goals might involve funding your children’s education, starting a business, or renovating your home. For these goals, you can afford to take on a bit more risk compared to short-term goals. You could consider a diversified portfolio of stocks and bonds. For instance, a mix of low-cost index funds that track the broad stock market and high-quality bond funds can provide growth potential while also offering some stability. As the investment horizon is longer, you have more time to ride out market fluctuations.

Long-Term Goals (10+ Years)

Long-term goals often revolve around retirement planning and building wealth for the future. Since you have a longer time frame, you can afford to have a more significant allocation to stocks. Historically, stocks have provided higher returns over the long run, although they come with greater short-term volatility. You could invest in a combination of domestic and international stocks, real estate investment trusts (REITs), and perhaps some alternative investments like commodities or precious metals to further diversify your portfolio. This diversification helps spread risk and potentially enhance returns over the long term.

Understand Your Risk Tolerance

Risk Tolerance Assessment

Your risk tolerance is a crucial factor in determining your investment strategy. It’s influenced by various factors such as your age, financial situation, investment experience, and personal temperament. There are several ways to assess your risk tolerance, including online questionnaires provided by financial institutions or consulting with a financial advisor. These questionnaires typically ask about your reaction to market volatility, your investment time horizon, and your financial goals. For example, if you are young and have a stable income, you may be more willing and able to tolerate short-term losses in pursuit of higher long-term returns. On the other hand, if you are close to retirement or have a low tolerance for risk, you may prefer a more conservative investment approach.

The Impact of Risk on Your Portfolio

Higher-risk investments, such as individual stocks or emerging market funds, have the potential for greater returns but also come with increased volatility. In a volatile market, the value of these investments can fluctuate significantly, which may cause anxiety if you are not comfortable with risk. On the contrary, lower-risk investments like government bonds or savings accounts offer more stability but generally provide lower returns. Striking the right balance between risk and return is essential. A well-diversified portfolio can help manage risk by spreading your investments across different asset classes. This way, if one investment performs poorly, others may offset the losses.

Diversify Your Investments

Asset Class Diversification

Diversification across asset classes is a fundamental principle of investing. This means spreading your inheritance across stocks, bonds, real estate, and cash equivalents. Stocks offer the potential for high returns but come with higher volatility. Bonds, on the other hand, provide stability and income. Real estate can act as a hedge against inflation and provide rental income. Cash equivalents, such as money market accounts and short-term CDs, offer liquidity and safety. For example, a typical diversified portfolio might consist of 60% stocks (including a mix of large-cap, mid-cap, and small-cap stocks, as well as international stocks), 30% bonds (government and corporate bonds), and 10% real estate and other alternative investments.

Geographical Diversification

In addition to diversifying across asset classes, it’s also important to consider geographical diversification. Investing in international stocks and bonds can provide exposure to different economies and markets, reducing the impact of any single country’s economic downturn on your portfolio. For instance, while the US stock market may be experiencing a slowdown, emerging markets or developed economies in Europe or Asia could be performing well. By including international investments in your portfolio, you can potentially enhance returns and reduce overall risk.

Diversification within Asset Classes

Within each asset class, further diversification is beneficial. For stocks, this could mean investing in different sectors such as technology, healthcare, finance, and consumer goods. In the bond market, you can diversify by investing in bonds with different maturities (short-term, medium-term, and long-term) and credit qualities (high-grade and high-yield). In real estate, you can consider residential, commercial, and industrial properties, as well as REITs that focus on different property types and locations.

Consider Professional Advice

The Role of a Financial Advisor

A financial advisor can provide valuable guidance and expertise in navigating the complex world of investing. They can help you assess your financial situation, define your goals, and develop a customized investment plan. A good financial advisor will take the time to understand your unique circumstances and risk tolerance. They can also provide ongoing portfolio monitoring and make adjustments as needed. For example, if the market experiences a significant shift or your personal circumstances change, the advisor can recommend changes to your asset allocation to keep you on track to meet your goals.

Choosing the Right Advisor

When selecting a financial advisor, look for someone who is qualified and has a good reputation. Check their credentials, such as certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Ask for referrals from friends, family, or colleagues who have had positive experiences with advisors. Interview multiple advisors to compare their investment philosophies, fees, and services. Ensure that the advisor is a fiduciary, which means they are legally obligated to act in your best interests.

Tax Considerations

Tax Implications of Different Investments

Different investment vehicles have varying tax implications. For example, interest income from bonds is generally taxed at your ordinary income tax rate, while long-term capital gains from stocks held for more than one year are taxed at a lower rate. Real estate investments may have depreciation deductions and potential capital gains tax implications when sold. Understanding these tax rules can help you optimize your investment strategy. For instance, if you are in a high tax bracket, you may want to consider tax-efficient investments such as municipal bonds, which are often exempt from federal income tax.

Tax-Efficient Investing Strategies

One tax-efficient strategy is to hold investments in tax-advantaged accounts such as IRAs (Individual Retirement Accounts) or 401(k)s. Contributions to these accounts may be tax-deductible, and the earnings grow tax-deferred until withdrawal. Another strategy is tax-loss harvesting, which involves selling investments that have declined in value to offset capital gains and potentially reduce your tax liability. Additionally, consider the location of your investments. For example, hold tax-inefficient investments like actively managed funds in tax-advantaged accounts and more tax-efficient investments like index funds in taxable accounts.

Regularly Review and Rebalance Your Portfolio

The Importance of Portfolio Review

Regularly reviewing your investment portfolio is essential to ensure that it remains aligned with your goals and risk tolerance. Markets change over time, and the performance of different asset classes can vary. Some investments may outperform while others may underperform, causing your portfolio to deviate from its original allocation. By reviewing your portfolio periodically, you can identify any imbalances and make necessary adjustments.

Rebalancing Your Portfolio

Rebalancing involves selling some of the overperforming assets and buying more of the underperforming ones to bring your portfolio back to its target allocation. For example, if stocks have had a strong run and now make up a larger percentage of your portfolio than intended, you may sell some stocks and use the proceeds to buy more bonds or other underweighted assets. Rebalancing helps maintain the desired risk and return characteristics of your portfolio and ensures that you are not overly exposed to any one asset class.

Conclusion

Investing your inheritance requires careful planning, a clear understanding of your goals and risk tolerance, and a commitment to regular review and adjustment. By taking the time to assess your current financial situation, define your short-term and long-term goals, diversify your investments, consider professional advice, and be mindful of tax implications, you can make the most of your inheritance and set yourself on a path to financial security and prosperity. Remember, the investment journey is not a one-time event but an ongoing process. Stay informed, be patient, and make decisions that are in line with your overall financial well-being. With the right approach, your inheritance can become a powerful tool for building a better financial future.

Related topics: