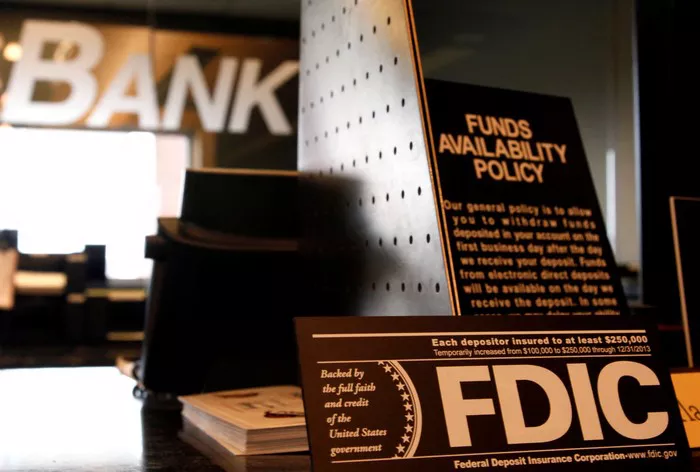

The Federal Deposit Insurance Corporation (FDIC) plays a crucial role in safeguarding the interests of depositors in the United States. Established in 1933 in response to the widespread bank failures during the Great Depression, the FDIC provides insurance coverage for deposits held at banks and savings institutions. Its primary function is to protect depositors by insuring their funds in case of bank insolvency or failure.

Scope of FDIC Insurance

FDIC insurance covers various types of deposit accounts, including savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts. This insurance protection extends up to a certain limit per depositor, per account ownership category, currently set at $250,000 per depositor, per insured bank. However, it’s essential to note that FDIC insurance does not apply to other types of investments, such as stocks, bonds, mutual funds, or annuities.

Difference Between Stocks and Deposit Accounts

Understanding the disparity between stocks and deposit accounts is fundamental. Stocks represent ownership stakes in companies, entitling shareholders to a portion of the company’s assets and profits. On the other hand, deposit accounts, as mentioned earlier, are financial instruments held at banks primarily for storing money and earning interest. While deposit accounts offer stability and FDIC insurance protection, stocks entail market risk and are subject to fluctuations in value based on various factors.

Investment Risks

Investing in stocks involves inherent risks that differ from those associated with deposit accounts. Stock prices are influenced by market volatility, company performance, economic indicators, geopolitical events, and investor sentiment. Unlike deposit accounts, where the principal amount is typically secure, the value of stocks can fluctuate significantly, and there’s no guarantee of returns. Investors must be prepared to withstand market downturns and fluctuations in the value of their stock investments.

Securities Investor Protection Corporation (SIPC)

While stocks are not insured by the FDIC, they may still be safeguarded through the Securities Investor Protection Corporation (SIPC). SIPC is a nonprofit membership corporation established by the U.S. Congress to protect customers of brokerage firms in the event of broker-dealer insolvency or failure. SIPC provides limited protection, covering up to a certain limit for cash and securities held in customer accounts, including stocks, bonds, and other securities.

Brokerage Account Protections

In addition to SIPC coverage, brokerage accounts may offer additional protections through private insurance or other arrangements. However, it’s crucial for investors to understand that these protections are distinct from FDIC insurance and may vary depending on the brokerage firm and the type of account. Before opening a brokerage account, investors should carefully review the account agreements and disclosures to understand the extent of protection provided.

Investment Strategies

Mitigating risks associated with stock investments requires careful planning and adherence to sound investment strategies. Diversification, which involves spreading investments across different asset classes, sectors, and geographical regions, can help reduce overall portfolio risk. Additionally, conducting thorough research, adopting a long-term investment approach, and seeking guidance from qualified financial professionals can assist investors in navigating the complexities of the stock market and making informed decisions.

Conclusion

In conclusion, while the FDIC does not insure stocks, investors have alternative avenues for protecting their investments. By understanding the risks associated with different types of investment vehicles and implementing prudent investment strategies, investors can work towards achieving their financial goals while minimizing exposure to undue risk. It’s essential for investors to remain vigilant, stay informed, and seek professional guidance when necessary to make sound investment decisions in today’s dynamic financial landscape.