Investing in precious metals like silver has been a popular choice for centuries. While gold often steals the spotlight, silver has its own unique advantages and characteristics that make it an attractive investment. But is it smart to buy silver? This article will explore various aspects of investing in silver, including its historical performance, market dynamics, and potential benefits and risks.

Historical Performance of Silver

Silver as a Historical Store of Value

Silver has been used as a form of money and a store of value for thousands of years. Ancient civilizations, including the Greeks and Romans, used silver coins for trade. Its intrinsic value and scarcity made it a reliable medium of exchange. Over time, silver’s role in the global economy has evolved, but it remains a valuable commodity.

Silver Prices Over the Decades

Examining silver prices over the past few decades reveals significant fluctuations. In the 1970s, silver prices soared due to high inflation and economic uncertainty. The Hunt brothers’ attempt to corner the silver market in 1980 led to a dramatic spike, followed by a steep decline. Since then, silver prices have experienced various peaks and troughs, influenced by factors such as industrial demand, inflation, and geopolitical events.

Market Dynamics of Silver

Supply and Demand Factors

Silver’s market dynamics are driven by both supply and demand factors. On the supply side, silver is primarily obtained as a byproduct of mining other metals like gold, copper, and zinc. This makes its supply somewhat dependent on the production levels of these metals. Additionally, recycling contributes to the silver supply.

On the demand side, silver has a wide range of applications. It is used in jewelry, electronics, solar panels, and various industrial processes. This diverse demand base provides some stability to the market. However, changes in industrial demand, especially from sectors like electronics and solar energy, can significantly impact silver prices.

Investment Demand for Silver

Investment demand plays a crucial role in silver’s market dynamics. Investors buy silver for various reasons, including hedging against inflation, diversifying their portfolios, and seeking a safe haven during economic uncertainty. Silver bullion, coins, and exchange-traded funds (ETFs) are popular investment vehicles.

Benefits of Investing in Silver

Hedge Against Inflation

One of the primary reasons investors turn to silver is to hedge against inflation. Like gold, silver is a tangible asset that tends to retain its value when fiat currencies lose purchasing power. During periods of high inflation, the demand for silver as a store of value often increases, driving up prices.

Diversification of Investment Portfolio

Diversifying a portfolio with silver can reduce overall risk. Precious metals often have a low correlation with traditional assets like stocks and bonds. This means that when the stock market experiences volatility, silver prices may move in a different direction, providing a counterbalance to the portfolio.

Industrial Demand and Technological Advancements

Silver’s extensive use in industrial applications is another benefit for investors. As technology advances, new uses for silver continue to emerge. For example, silver’s role in the production of solar panels has grown significantly in recent years. The push for renewable energy sources suggests that industrial demand for silver could remain strong.

Relative Affordability Compared to Gold

Silver is often considered more accessible to average investors compared to gold. Its lower price per ounce allows investors to purchase larger quantities. This affordability can make silver an attractive option for those looking to enter the precious metals market without a significant upfront investment.

See Also: Does the Stock Market Crash Have an Impact on Silver Prices?

Risks of Investing in Silver

Price Volatility

One of the main risks of investing in silver is its price volatility. Silver prices can be more volatile than gold due to its smaller market size and the dual nature of its demand (industrial and investment). This volatility can lead to significant price swings, which may be unsettling for some investors.

Market Manipulation

The silver market has been subject to manipulation in the past. The Hunt brothers’ attempt to corner the market in the 1980s is a well-known example. More recently, allegations of price manipulation by large financial institutions have surfaced. Such activities can distort market prices and create uncertainty for investors.

Storage and Security Concerns

Physical silver requires secure storage. Investors must consider the costs and logistics of storing silver bullion or coins. Additionally, the risk of theft or loss can be a concern. While ETFs and other paper silver investments eliminate the need for physical storage, they come with their own set of risks, including counterparty risk.

Economic Factors and Industrial Demand Fluctuations

Silver’s industrial demand makes it susceptible to economic cycles. During economic downturns, industrial demand for silver may decrease, leading to lower prices. Conversely, during economic expansions, increased industrial activity can boost demand and prices. Investors must be aware of these fluctuations and their potential impact on silver investments.

Comparing Silver to Other Investments

Silver vs. Gold

While silver and gold are both precious metals, they have different characteristics as investments. Gold is often seen as a more stable and less volatile asset compared to silver. It is primarily viewed as a safe haven and store of value. Silver, on the other hand, has a larger industrial component, making it more susceptible to economic cycles.

Gold’s higher price per ounce also means that it requires a larger initial investment. Silver’s lower price makes it more accessible, but it also means that it can experience more significant percentage price changes.

Silver vs. Stocks and Bonds

Investing in silver offers a way to diversify away from traditional financial assets like stocks and bonds. Stocks represent ownership in companies and can provide dividends and capital gains, while bonds are debt instruments that offer fixed interest payments. Silver does not generate income but can provide capital appreciation and a hedge against inflation.

Stocks and bonds are influenced by different factors, such as corporate earnings, interest rates, and economic policies. Silver’s performance is driven by supply and demand dynamics in the commodities market. This makes silver a valuable addition to a diversified investment portfolio.

Silver vs. Real Estate

Real estate is another popular investment option that provides income through rental payments and potential capital appreciation. Unlike silver, real estate is a tangible asset that requires management and maintenance. It also has higher transaction costs and less liquidity compared to silver.

However, real estate can provide a steady income stream and tax advantages. Silver, on the other hand, is more liquid and easier to buy and sell. Both asset classes can serve as a hedge against inflation, but they offer different risk and return profiles.

How to Invest in Silver

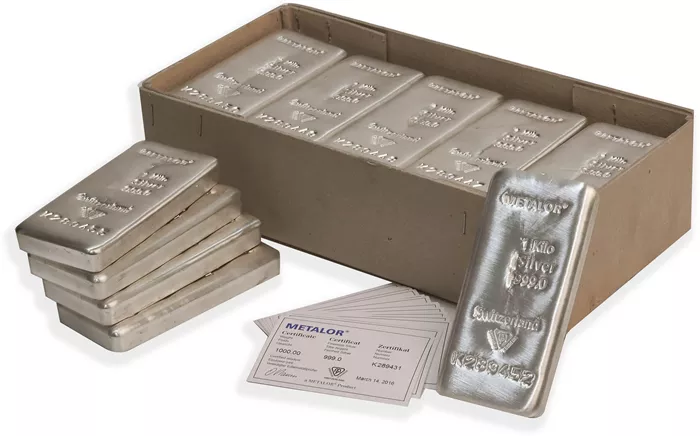

Physical Silver

Investing in physical silver involves purchasing silver bullion, coins, or bars. This method provides direct ownership of the metal. Investors can store physical silver at home, in a safe deposit box, or with a professional storage facility. Popular silver coins include the American Silver Eagle, Canadian Silver Maple Leaf, and the Austrian Silver Philharmonic.

Silver ETFs and Mutual Funds

Silver ETFs and mutual funds offer a way to invest in silver without the need for physical storage. These funds track the price of silver and trade on stock exchanges. Examples include the iShares Silver Trust (SLV) and the Sprott Physical Silver Trust (PSLV). Investing in these funds provides exposure to silver’s price movements with the convenience of trading like a stock.

Silver Mining Stocks

Investing in silver mining stocks is another way to gain exposure to silver. These stocks represent ownership in companies that explore for and produce silver. Silver mining stocks can provide leveraged exposure to silver prices, meaning that their prices can rise or fall more dramatically than the price of silver itself. Examples of silver mining companies include Pan American Silver Corp, First Majestic Silver Corp, and Silvercorp Metals Inc.

Silver Futures and Options

Futures and options are derivative instruments that allow investors to speculate on silver prices or hedge their positions. Silver futures contracts are standardized agreements to buy or sell a specific amount of silver at a predetermined price on a future date. Options give investors the right, but not the obligation, to buy or sell silver at a specific price before a certain date. These instruments require a higher level of knowledge and risk tolerance.

Factors to Consider When Investing in Silver

Market Research and Analysis

Conducting thorough market research and analysis is crucial when investing in silver. Investors should stay informed about factors that influence silver prices, such as industrial demand, economic indicators, and geopolitical events. Understanding these dynamics can help investors make informed decisions.

Investment Goals and Time Horizon

Investors should consider their investment goals and time horizon when investing in silver. Silver can be a good long-term investment for those looking to hedge against inflation and diversify their portfolios. However, its price volatility may not suit short-term investors seeking quick gains.

Risk Tolerance

Understanding one’s risk tolerance is essential. Silver’s price volatility can lead to significant gains but also substantial losses. Investors should assess their risk tolerance and ensure that their investment in silver aligns with their overall risk management strategy.

Diversification

Diversifying investments is a key principle in managing risk. While silver can be a valuable addition to a diversified portfolio, it should not be the sole investment. Balancing silver with other asset classes, such as stocks, bonds, and real estate, can help mitigate risk.

The Future of Silver Investment

Technological Innovations and Industrial Demand

The future of silver investment is closely tied to technological innovations and industrial demand. Silver’s unique properties make it indispensable in various applications, including electronics, solar energy, and medical devices. As technology advances, new uses for silver are likely to emerge, potentially boosting demand.

Environmental and Sustainability Trends

Environmental and sustainability trends also play a role in silver’s future. The push for renewable energy sources, such as solar power, relies heavily on silver. Governments and industries are increasingly focusing on sustainability, which could drive long-term demand for silver.

Economic and Geopolitical Factors

Economic and geopolitical factors will continue to influence silver prices. Inflation, currency fluctuations, and geopolitical tensions can impact investor sentiment and demand for safe-haven assets like silver. Monitoring these factors is essential for investors.

Market Sentiment and Speculative Activity

Market sentiment and speculative activity can lead to short-term price fluctuations in silver. Investors should be aware of trends in the broader financial markets and sentiment towards precious metals. Speculative activity can create opportunities but also increase volatility.

Conclusion

Investing in silver offers both opportunities and challenges. Its historical role as a store of value, coupled with its industrial applications, makes it a unique investment. Silver can serve as a hedge against inflation, diversify a portfolio, and provide exposure to technological advancements.

However, investors must be aware of the risks, including price volatility, market manipulation, and storage concerns. Thorough research, a clear understanding of investment goals, and a well-diversified portfolio are essential for smart investing in silver.

In conclusion, buying silver can be a smart investment for those who understand its dynamics and are prepared for its potential risks and rewards. Whether as a hedge against inflation, a portfolio diversifier, or a bet on industrial demand, silver remains a valuable and versatile asset in the world of investing.