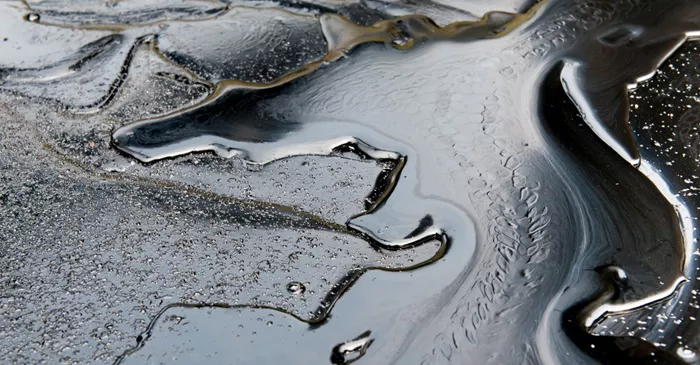

Oil prices hovered close to a seven-month low as a sharp decline in global financial markets counterbalanced escalating tensions in the Middle East. Traders are closely monitoring the situation for any potential retaliatory actions from Iran against Israel.

Brent crude futures were trading around $77 per barrel, maintaining near their lowest closing levels since early January. Meanwhile, West Texas Intermediate (WTI) crude was steady around $74 per barrel. The global stock market experienced a downturn on Monday, driven by worries that the Federal Reserve might postpone its response to a slowing U.S. economy.

Despite these concerns, the market remains on edge over the possibility of a retaliatory strike from Iran and its allied militias against Israel, following the recent assassinations of Hezbollah and Hamas officials. In response, the U.S. has deployed additional defensive forces to the region.

Oil prices have faced a downward trend for four consecutive weeks, influenced by signs of weakening demand in the U.S. and China. Over the weekend, China announced new measures to boost domestic consumption. Oil prices have remained relatively stable for the year, buoyed by OPEC+ supply cuts and worries about potential disruptions to Middle Eastern oil production.

Warren Patterson, Head of Commodities Strategy at ING Groep NV in Singapore, noted that while demand concerns are growing, geopolitical risks continue to impact the oil market. Patterson indicated that while escalating tensions could cause short-term price volatility, a significant disruption in crude supply is necessary for a sustained price increase.

U.S. Secretary of State Antony Blinken informed G-7 allies on Sunday that an Iranian and Hezbollah attack on Israel could commence as early as Monday, according to Axios, which cited sources familiar with the briefing. Although the exact timing is uncertain, Blinken suggested that strikes might begin within the next 24 to 48 hours.

In other developments, Saudi Arabia increased the price of its flagship crude for Asian buyers for the first time in three months, indicating a cautious optimism about regional demand. However, the kingdom also reduced prices for Europe and the U.S.