Exchange-Traded Funds (ETFs) have transformed the investment landscape over the past few decades. Among the various types of ETFs available, passively managed ETFs have gained immense popularity due to their simplicity and cost-effectiveness. But what exactly are these financial instruments, and how do they work? In this article, we will explore the fundamentals of passively managed ETFs, their benefits and drawbacks, and how they compare to actively managed ETFs.

Understanding Passively Managed ETFs

Definition of Passively Managed ETFs

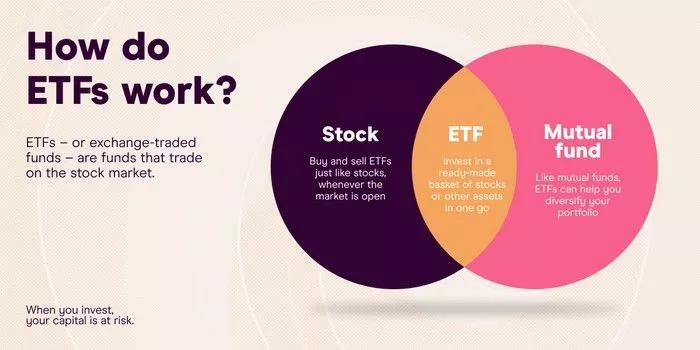

A passively managed ETF is a type of investment fund that aims to replicate the performance of a specific index, sector, or asset class. Unlike actively managed funds, where portfolio managers make decisions about buying and selling securities based on research and analysis, passively managed ETFs follow a predetermined strategy. They invest in the same securities that comprise the index they are tracking, maintaining a similar weightage.

For example, a passively managed ETF tracking the S&P 500 would hold shares of the 500 companies included in that index, mimicking its performance as closely as possible.

How Do Passively Managed ETFs Work?

Passively managed ETFs are designed to mirror the performance of their underlying index. When investors buy shares of a passively managed ETF, they essentially invest in a diversified portfolio of stocks or bonds that reflect the composition of the tracked index. The fund manager’s role is primarily to maintain the ETF’s holdings in line with the index, ensuring that the fund remains aligned with its investment objective.

When the index changes, whether due to new companies being added or existing ones being removed, the ETF adjusts its holdings accordingly. This passive management strategy minimizes trading activity, reducing costs associated with frequent buying and selling.

The Structure of Passively Managed ETFs

Composition of ETFs

Passively managed ETFs typically comprise a basket of securities that represent a particular index. The fund’s composition can include stocks, bonds, commodities, or a mix of these assets. For instance, a bond ETF might focus on government or corporate bonds, while an equity ETF could target specific sectors, such as technology or healthcare.

Investors can gain exposure to a wide range of markets through passively managed ETFs, making them an attractive option for diversified investing.

Net Asset Value (NAV)

The Net Asset Value (NAV) of a passively managed ETF is calculated at the end of each trading day. It represents the total value of the ETF’s holdings divided by the number of outstanding shares. This value is crucial for investors, as it determines the price at which shares can be bought or sold. Since ETFs trade on stock exchanges, their market price can fluctuate throughout the day based on supply and demand. However, the NAV provides a baseline for understanding the fund’s value.

Expense Ratios

One of the most significant advantages of passively managed ETFs is their low expense ratios. Because these funds do not require active management, they typically charge lower fees compared to actively managed funds. Lower expense ratios mean that more of the investor’s returns can be retained, contributing to overall portfolio growth over time.

Benefits of Passively Managed ETFs

Cost-Effectiveness

The low expense ratios associated with passively managed ETFs make them a cost-effective investment option. With fewer management fees and trading costs, investors can save significantly over time. This cost advantage is particularly beneficial for long-term investors, as lower fees can compound, enhancing overall returns.

Simplicity and Transparency

Passively managed ETFs are straightforward to understand. Investors know exactly what they are investing in since the ETF tracks a specific index. This transparency allows investors to make informed decisions without the complexities often associated with actively managed funds. Moreover, the holdings of passively managed ETFs are typically disclosed daily, providing investors with a clear view of their investments.

Diversification

Investing in a passively managed ETF offers instant diversification. Since these funds track indices, investors gain exposure to a broad range of securities within that index. This diversification can help reduce individual stock risk, making passively managed ETFs an attractive option for risk-averse investors.

Market Performance

Numerous studies have shown that passively managed funds often outperform actively managed funds over the long term. Many active managers struggle to consistently beat their benchmark indices after accounting for fees and expenses. As a result, passively managed ETFs have become increasingly popular among investors looking for reliable market exposure.

Drawbacks of Passively Managed ETFs

Lack of Flexibility

While the passive management approach has many advantages, it also has its drawbacks. One of the most significant limitations of passively managed ETFs is their lack of flexibility. The fund manager cannot deviate from the index, meaning they cannot respond to changing market conditions or capitalize on specific investment opportunities. This rigidity can be a disadvantage during volatile or rapidly changing market environments.

Tracking Error

Another concern with passively managed ETFs is tracking error. Tracking error refers to the difference between the performance of the ETF and the performance of the index it aims to replicate. Factors such as fees, market liquidity, and the timing of trades can lead to discrepancies between the ETF’s performance and that of the underlying index. While most passively managed ETFs strive to minimize tracking error, it can still occur.

Potential for Overexposure

Investors should also be cautious about overexposure to specific sectors or industries. While diversification is a key benefit of passively managed ETFs, some indices may be heavily weighted toward a particular sector. For instance, if an ETF tracks a technology-heavy index, it may expose investors to increased risks if the technology sector underperforms.

see also: What is an ETF Trust?

Comparing Passively Managed ETFs to Actively Managed Funds

Investment Strategies

Passively managed ETFs focus on replicating the performance of an index, while actively managed funds employ portfolio managers to make investment decisions based on research and analysis. This fundamental difference shapes the way each type of fund operates and ultimately impacts investor returns.

Cost Differences

As previously mentioned, passively managed ETFs generally have lower expense ratios compared to actively managed funds. Investors need to consider these cost differences when deciding which investment vehicle aligns with their financial goals.

Performance Metrics

Studies often show that passively managed ETFs outperform a significant percentage of actively managed funds, especially over longer investment horizons. This performance disparity is primarily attributed to the high fees associated with active management and the difficulty many managers face in consistently beating their benchmarks.

Conclusion

Passively managed ETFs offer a unique investment opportunity for those seeking diversified exposure to various asset classes with low costs and simplicity. Their straightforward nature, low expense ratios, and historical outperformance make them attractive to a wide range of investors. However, it is essential to understand their limitations, including a lack of flexibility and potential tracking error.

In today’s complex investment landscape, passively managed ETFs represent a compelling option for both novice and experienced investors. By understanding what these funds are and how they work, investors can make informed decisions that align with their financial objectives. As the popularity of passively managed ETFs continues to rise, they are likely to remain a staple in the investment portfolios of many individuals seeking long-term growth and diversification.

Related topics: