The global financial markets, especially in the United States, offer vast opportunities for investors. Non-residents often wish to access these markets to diversify their portfolios or benefit from the robust growth of US companies. For this purpose, a US brokerage account becomes a crucial tool. But what exactly is a US brokerage account for non-residents, and how does it work?

This article provides a detailed explanation of US brokerage accounts for non-residents, their significance, the steps to open one, and the factors to consider before diving in.

Understanding a US Brokerage Account

What Is a Brokerage Account?

A brokerage account is a financial account that allows individuals to buy, sell, and hold investments such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These accounts are managed by brokerage firms, which facilitate transactions on behalf of the account holder.

How It Differs for Non-Residents

A US brokerage account for non-residents functions similarly to one for residents but with additional requirements. Non-residents must comply with US tax laws and international regulations, and they may face restrictions on certain types of investments.

Why Non-Residents Open US Brokerage Accounts

Access to US Markets

The US stock market is home to some of the largest and most influential companies in the world, including Apple, Amazon, and Microsoft. A US brokerage account allows non-residents to invest directly in these companies.

Diversification

Investing in US markets provides geographical and sectoral diversification, reducing the risks associated with investing solely in domestic markets.

Strong Regulatory Framework

The US financial system is known for its transparency and investor protection measures, making it an attractive option for global investors.

Opportunities for Growth

The US markets have historically delivered strong returns over the long term, making them a lucrative choice for investors seeking growth.

Steps to Open a US Brokerage Account for Non-Residents

1. Choose a Brokerage Firm

Several US brokerage firms cater to non-residents, including Charles Schwab, Interactive Brokers, and TD Ameritrade. Each has its own set of features, fees, and account requirements.

2. Provide the Necessary Documentation

Non-residents typically need to provide:

- A valid passport.

- Proof of residency in their home country.

- A completed W-8BEN form to comply with US tax regulations.

3. Fund the Account

Once the account is approved, you can fund it by transferring money from your home country’s bank account. Most brokerages accept wire transfers in multiple currencies.

4. Start Investing

After funding your account, you can begin trading in stocks, bonds, ETFs, and other securities available in the US market.

Key Considerations for Non-Residents

Tax Implications

Non-residents investing in the US are subject to specific tax rules. For instance, dividends from US stocks may be subject to a 30% withholding tax unless reduced by a tax treaty between the US and the investor’s home country.

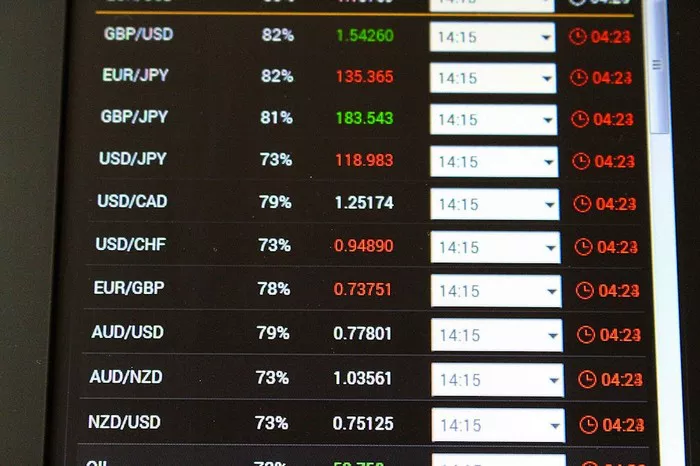

Currency Exchange Rates

Since investments are made in US dollars, fluctuations in currency exchange rates can impact your returns. It’s important to monitor these rates and consider their effect on your investments.

Regulatory Compliance

Non-residents must adhere to US regulations, including providing accurate information on tax forms like the W-8BEN. Failure to comply can result in penalties.

Account Restrictions

Some brokerages may impose restrictions on certain investment types or services for non-residents. For example, mutual funds or retirement accounts might not be available.

Top US Brokerage Firms for Non-Residents

1. Charles Schwab

Charles Schwab is known for its user-friendly platform and robust customer support. It offers a wide range of investment options and has no minimum deposit requirement for international accounts.

2. Interactive Brokers

Interactive Brokers is ideal for active traders. It provides access to global markets, competitive pricing, and advanced trading tools.

3. TD Ameritrade

TD Ameritrade is popular for its educational resources and intuitive platform. It caters to beginners and experienced investors alike.

4. Fidelity Investments

Fidelity offers comprehensive investment options and strong research tools. It has a reputation for excellent customer service.

Benefits of Investing Through a US Brokerage Account

Liquidity

US markets are highly liquid, meaning you can buy and sell investments quickly without significantly affecting their prices.

Diversification of Investment Options

US brokerage accounts provide access to a variety of asset classes, including stocks, bonds, ETFs, and options, enabling you to build a diversified portfolio.

Technological Advancements

Many US brokerage firms offer advanced trading platforms with features like real-time data, analytical tools, and mobile apps, making investing more accessible.

Global Reputation

Investing in US markets adds credibility to your portfolio due to the global recognition of US financial markets.

Challenges for Non-Residents

Tax Complexity

Navigating US tax laws can be challenging for non-residents. It’s advisable to consult a tax professional to ensure compliance.

Higher Costs

Currency conversion fees, wire transfer charges, and potential double taxation can increase the cost of investing through a US brokerage account.

Access Restrictions

Some brokerages may have country-specific restrictions, limiting access to non-residents from certain regions.

Time Zone Differences

Trading hours in the US may not align with your local time, making it necessary to plan trades accordingly.

How to Make the Most of a US Brokerage Account

Stay Informed

Keep up with market trends, economic news, and updates from the companies you invest in. This knowledge will help you make informed decisions.

Leverage Research Tools

Many US brokerages provide research reports, stock analysis, and market insights. Utilize these resources to identify investment opportunities.

Monitor Your Portfolio

Regularly review your investments to ensure they align with your financial goals. Adjust your portfolio as needed to stay on track.

Conclusion

A US brokerage account for non-residents is an excellent gateway to the world’s largest and most dynamic financial markets. While the process involves additional documentation and regulatory compliance, the benefits of accessing US markets outweigh these challenges for many investors.

By choosing a reliable brokerage firm, understanding tax implications, and leveraging the available tools and resources, non-residents can successfully navigate the complexities of US investing. Whether you’re looking to diversify your portfolio, tap into the growth of US companies, or take advantage of a stable regulatory environment, a US brokerage account offers numerous opportunities for global investors.

Related topics:

How Do You Set up a Brokerage Account